I just learned that RAMP has updated the submission policy structure to be a lot more flexible now.

With the new designer it is now possible to require receipts for certain Merchant Category classes, so this allows us to limit the $75 rule to only very specific merchant classes that are typical in travel. (e.g. restaurants, gas stations, taxis, etc.)

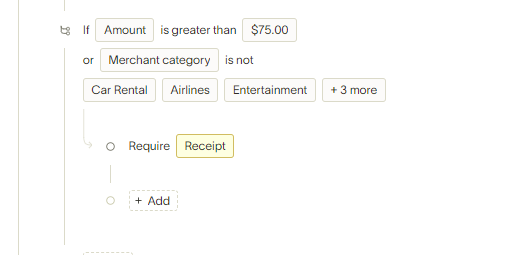

See below a screenshot how I just set it up to be a lot closer to IRS compliance.