Hello! I’m Sammy, Ramp’s Senior Accountant and I’ve worked on a myriad of our accounts in my tenure, both on the Balance Sheet and P&L. I’ve also led our 1099 filing efforts for the past two calendar years and have deeply felt the pain points that come with the conventional reporting.

Filing all your needed 1099s is often an additional grind, from confirming tax information to making sure you get your filings to the finish line by the January 31st deadline. Here are a few tips and tricks to have Ramp help ensure you have a smoother and more automated 1099 filing experience!

-

Ramp is designed to detect 1099 vendors automatically, based on payments made throughout the year and the tax details input into Ramp. It’s never too early to begin checking your Vendors tab in Ramp and making sure you have up-to-date tax information for eligible vendors.

-

Use your ability to override the 1099 toggle, which can be seen on the “Tax Info” tab on the individual Vendor page, for the tax year if you have more customized vendor profiles.

-

Reach out to vendors you need updated information from directly from Ramp. Instead of drafting bulk emails, you can have Ramp send an email request to have vendors directly fill in their own tax details, reducing the amount of back and forth. This can also be initiated from the “Tax Info” tab on the individual Vendor page

-

Ramp will verify vendor tax information by verifying the TIN and business legal name with the IRS. This saves you the time of attempting to use a TIN matching software or attempting to do so manually with the IRS.

-

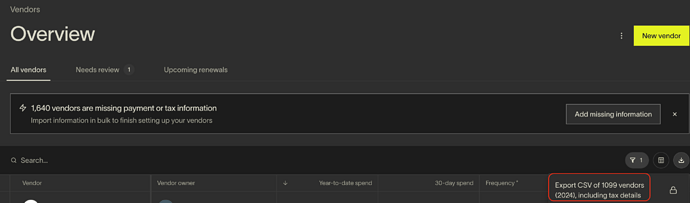

Ramp enables you to generate and export your 1099 vendor report in CSV or Excel format, which can be exported from Vendors page (see the screenshot below!). This report can be easily uploaded to tax filing software, streamlining the filing process.